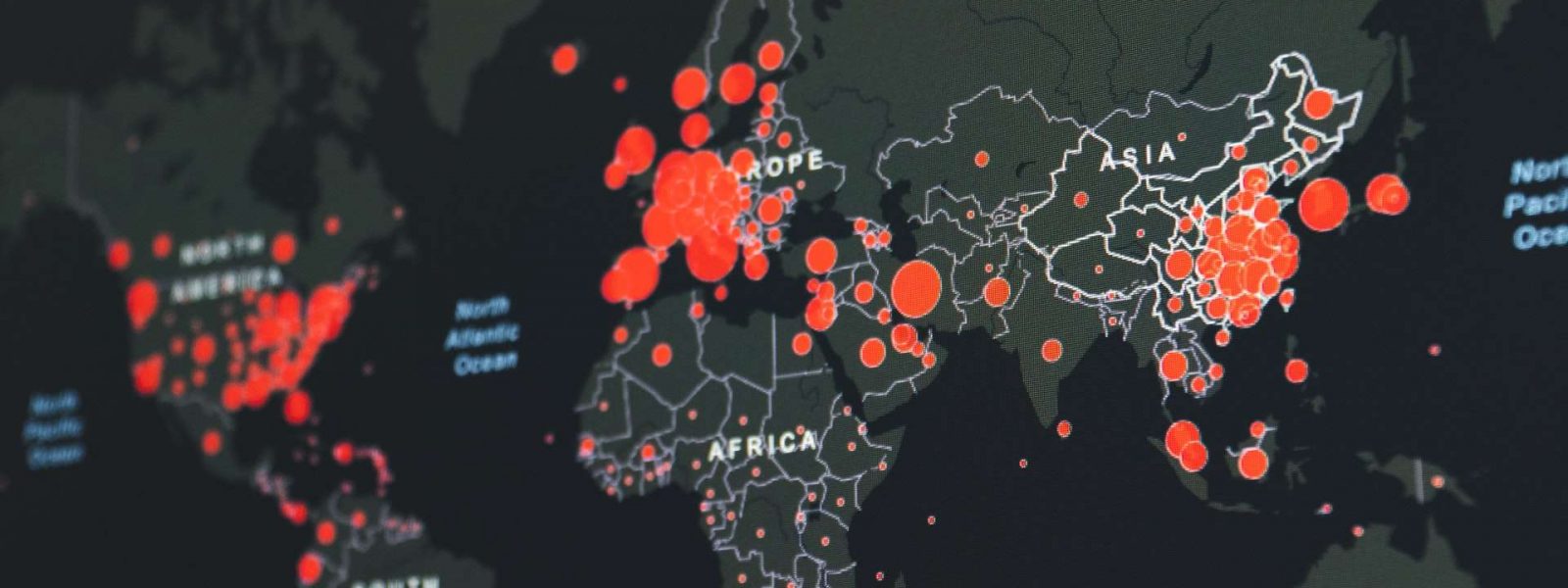

Coronavirus will surely be chosen as the word of the year in numerous languages. There is no newspaper or informational cover that does not open its information without the updated part of the disease across the planet. And all this despite so many voices that call for calm, because its real impact on the health security of the population in general is at most very limited, given that basically it is only a variant of the flu whose Mortality rate does not exceed just 2% (less than 1% outside the Asian focus) and is mainly primed due to death in elderly people with various previous pathologies.

Another very different aspect may be its influence on the economic development in the short term. The hysteria generated is having its most damaging reflection in the financial markets, especially in the stock exchanges of the developed world (curiously the best prepared to deal with the supposed health emergency) and it may also – everything points to it – be the cause of notable declines in the GDP of some countries. The financial impact of the “bug” in question will have a lot to do with the health control of the epidemic in the coming months, but especially with the treatment of this episode by the media and social networks.

On the treatment in networks I manifest already my blackest pessimism – lost cause -, but on the treatment in the media one would expect some more responsibility and rigour. However, these events once again highlight how tremendously vulnerable the stock markets are to any unexpected event or surprise. Hence, when looking for a safe, stable and poorly profitable return to scares or anguish, real estate investment, that is, “real-life” real estate investment appears as the clearest option or alternative.

The financial world will argue that the liquidity factor plays in its favor – the possibility of converting any financial asset quickly into liquid, that is, in cash, quickly – but it is precisely that liquidity that is the most vulnerable, since as is the case With the transmission of the virus, the routes of infection are always “liquid”. Or, put another way, “the brick” does not get the coronavirus.

As in the game of the musical chair – in which the players are left without a chair when the music stops – when the music of the coronavirus will stop there will be many losers and, of course, also a great winner who will take it all, But those who have invested in real estate will simply observe the outcome of the game from their terrace without further worries.

.